Blogs

A card-creator mortgage is one way to provide a fees mortgage to your credit history. Alternatively, it’s added to a locked account that you can’t access until you’ve produced all your monthly obligations. In other words, you earn the borrowed funds count after payment, not first.

Ideas on how to calculate the full cost of a loan

Following the partners had married, they seen the debt since the a mutual duty playing while the a group. For example, the fresh Citi Custom Cash Card try a no-annual-payment rewards cards which have an excellent 0% intro Annual percentage rate to your purchases to own 15 days. What’s more, it also provides 5% money back to the around $five-hundred 30 days in home improve shop using (in case it is their better paying classification), and you may step one% cash back to your some other sales. Having HELOCs, you could potentially withdraw finance as needed and certainly will pay just interest on what you obtain.

Secret differences when considering personal and federal figuratively speaking

- For the reason that handmade cards generally have high rates versus most other borrowing from the bank points on this listing.

- You could imagine combining your current higher-focus personal debt that have a debt negotiation financing.

- Splash markets money provide fixed cost between 8.99% Annual percentage rate in order to 35.99% Apr and you can terms of 2 in order to 7 many years.

- If you are handmade cards may be a necessary convenience, they could also get costly prompt.

- Yet not, your interest isn’t the only factor you have to know.

Exchange in your cellular telephone, tablet, smartwatch or any other product is effortless with our Equipment Change-inside Program. Simply inform us the machine and its own position and also you’ll score another one to, instant borrowing from the bank, membership borrowing from the bank, or current cards. The cash Splash symbolization is the higher-investing icon and you may triggers the newest progressive jackpot whenever lined up precisely. Besides the progressive jackpot, Bucks Splash doesn’t have extra incentive has or 100 percent free revolves. You should bet the maximum coins for the all paylines getting entitled to the new progressive jackpot. In order to win the fresh modern jackpot, you need to home 5 Bucks Splash logo designs on the 15th payline.

The way we see it is that you can sometimes go for the Cold and you can freeze your clothes away from, or you can has a go associated with the totally free Icy Bucks Splash slot machine game from Cashbet app. The video game will show you all you need to find of the newest natural environment, out of larger old walruses, so you can beluga whales and a majestic polar sustain. You’ll also can see certain penguins which don’t in fact are now living in the brand new Cold. The brand new picture of the slot machine could possibly make up for for example a geographical error while the three-dimensional outcomes give each of the fresh dogs alive that have high clarity and you may vigour. If you’d like to register you, you will find a huge amount of benefits for our Splash Winos. If you want wines, it only is sensible to become a great Splash Wino today.

Without any burden away from $46,000 inside college loans, Andrea you are https://mrbetlogin.com/hot-cross-bunnies-game-changer/ going to focus on building her career. She is actually a professor for nearly 10 years ahead of employed in private routine because the a clinical son psychologist. Many of these efforts worked, while the Andrea paid off the woman student education loans in full within the March 2013, merely half a year immediately after graduating along with her doctorate.

Splash and you can SoFi one another offer unsecured loans as much as $100,one hundred thousand to have really-certified borrowers, however, Splash is most beneficial if you’d like below $5,100000. If the score is actually below SoFi’s 680 minimum, you could here are some Splash, since it doesn’t publish the very least credit rating for its mortgage choices. However, if one makes quick costs, you can replace your credit history long-identity. Along with, if you use a loan to repay personal credit card debt, you could potentially rapidly decrease your credit utilization (and therefore contributes up to 29% to the FICO credit history) and find out short credit progress. Reputable evaluated an educated personal loan loan providers considering items such as while the buyers feel, mortgage numbers, funding go out, mortgage conditions and you may charge.

There are personal loans because of banking institutions, credit unions, otherwise on line loan providers. Loan quantity normally range between as little as $600 in order to $50,100 or more, according to your borrowing, money, as well as the bank. Payment terminology ranges out of two to help you seven decades, and you will yearly fee costs (APRs) is less than credit cards, typically. With respect to the Federal Set-aside, the common Apr to the playing cards are 21.47%, while the average speed to own an excellent twenty four-few days consumer loan is actually 12.32%. Citi offers zero-payment unsecured loans to borrowers with pretty good borrowing from the bank (a good FICO credit score from 740 or more).

They won’t need a credit assessment as the amount your use will be based upon retirement balance (it’s your currency). Which is great when you yourself have got issue qualifying for a good unsecured loan due to your credit. Yet not, all you obtain wouldn’t earn focus until you pay it off. Lenders discover borrowers which have poor credit as the riskier since the there’s an excellent higher chance of her or him not paying off financing. To minimize it exposure, loan providers you are going to provide only quicker installment terms, such you to, a few, otherwise three years, to settle that loan. Weigh the advantages and you will drawbacks of a bad borrowing personal bank loan is vital before applying, particularly when you are proactively seeking to replace your credit history.

What’s loan consolidation?

Pay day loan and bank card bucks benefits are two sort of high-focus financial obligation to quit. You happen to be tempted because of the such financing while they’re very easy to be eligible for, but they’re also rarely worth every penny. The newest APRs for the payday loans is just as higher while the nearly 400%, with respect to the Individual Economic Defense Bureau.

They use your residence because the collateral, so if you default, the lender can be seize they. You really must have a good FICO score with a minimum of 600 and at least money out of $twenty-five,000 annually to help you meet the requirements. There are many cheaper options so you can borrowing money due to an excellent payday advance loan. Relative to most other bad-borrowing from the bank finance, the fresh fees to possess sixty Week Money arrive practical.

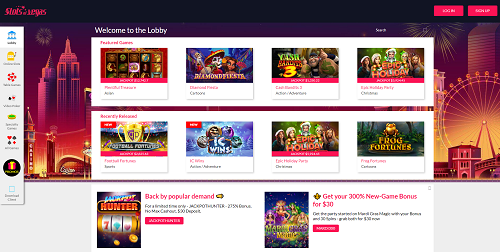

Thus even although you are not looking for simple one to-armed fresh fruit machines and you will vintage harbors, Bucks Splash usually contrary to popular belief excite you which have just how uncommon and intuitive it is. It’s an old slot changed to a slot machine game servers which have an improve away from three to five reels. It offers all the appeal of your own antique on the best earnings of the games. Totally free professional instructional programs to have on-line casino staff geared towards globe guidelines, boosting player experience, and you can fair method of betting. Our very own CashSplash Gambling enterprise review will provide you with a chance to get familiar to your gambling establishment, their security, fairness, pros and cons, reading user reviews, and more.

Dental care people and you may fellows are unable to discover more university fees obligations for the duration of their House Several months; find SoFi.com/qualifications for facts. Come across Annual percentage rate instances and you may words SoFi.com/medical-resident-refinance/medical-resident-refinance-rates. SoFi refinance financing is actually private finance and do not have the exact same payment alternatives that government financing system offers for example Earnings Centered Installment otherwise Money Contingent Installment otherwise PAYE or REPAYE. At the same time, federal student education loans offer deferment and you may forbearance alternatives which are not designed for SoFi Credit Corp. otherwise an affiliate Scientific otherwise Dental care Citizen Home mortgage refinance loan consumers. An individual mortgage is actually disbursed in one single lump sum and paid in the monthly obligations having a predetermined rates and place term. Unlike a charge card, you’ll know exactly should your personal debt would be repaid.

You could remove your own eligibility to have federal student support and have difficulties taking out the newest finance to cover the rest of your training. Various other advantage of a longer financing name is the possibility to combine several fund. If you have multiple shorter financing with 10-seasons payment terms, refinancing is mix her or him for the one to extended-label mortgage which have a reduced monthly payment, simplifying your own cost procedure. Controlling several credit cards or finance can simply be challenging. Every month, you have to track various other due dates and you will minimum repayments.